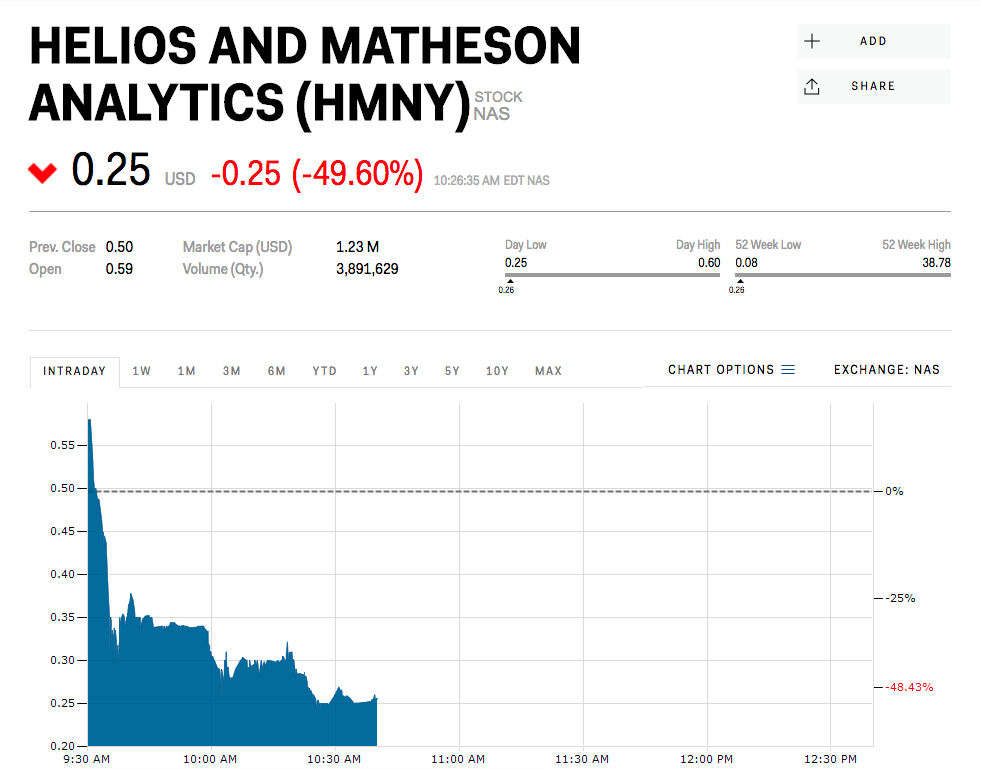

- Shares of MoviePass owner Helios & Matheson are down nearly 50% Wednesday.

- The selling comes after the company announced a new restriction on its service.

- Helios & Matheson shares have plunged more than 99% this year.

Shares of MoviePass owner Helios & Matheson are crashing Wednesday – down almost 50% at $0.25 apiece – less than 24 hours after announcing a new restriction on its service.

Late Tuesday, the movie-subscription service said it would no longer guarantee that every movie showtime will be available on its app. That announcement came less than a day after MoviePass said it would raise prices from $10 a month up to $14.99 and that it wouldn’t support big-ticket movies like “The Meg” or Disney’s “Christopher Robin” until weeks after their releases. The company says these changes could help reduce its cash burn by 60%.

Shares of Helios & Matheson have been in a downward spiral this year, plunging by more than 99%. Last week, the company announced a 1-for-250 reverse stock split in an attempt to lift its share price above the Nasdaq’s $1 minimum.

The reverse split temporary propped up the value of Helios & Matheson shares to $22.50, but that same day they began plunging again. A few days later, the MoviePass app began to experience a “service interruption” because its owner was unable to make certain required payments. HMNY had to borrow $5 million to get the app up and running again.

Helios & Matheson is expected to report its second-quarter results on August 14.